Electric Car Sales December 2025: Brand-wise EV Market Share

India’s electric four-wheeler (E4W) market closed December 2025 on a softer note, with total registrations easing to 17,438 units, down 5% month-on-month from November’s 18,374 units.

The slowdown reflects a typical year-end correction after the festive buying cycle, combined with delivery batching and inventory realignments across OEMs.

Despite the moderation, market leadership remained unchanged. Tata.ev, MG Motor India, and Mahindra Electric Automobile continued to dominate India’s passenger EV space, together accounting for the bulk of monthly volumes.

Their performance highlights the resilience of mass-market electric models even during correction phases.

India’s electric passenger vehicle (EV) market closed CY2025 on a strong growth note, registering 1,76,538 electric cars and SUVs, marking a 77% year-on-year increase over CY2024, as per Vahan registration data.

The data below presents the updated brand-wise EV car sales ranking for December 2025, based on Vahan registration records, offering a clear view of how India’s electric passenger vehicle market closed the calendar year.

Top Electric Car Companies – December 2025 (India)

| Brand | Nov ’25 Sales | Dec ’25 Sales | MoM Change |

|---|---|---|---|

| Tata Passenger Electric Mobility Ltd | 7,556 | 7,408 | -2% |

| JSW MG Motor India Pvt Ltd | 4,602 | 4,302 | -7% |

| Mahindra Electric Automobile Ltd | 3,713 | 3,679 | -1% |

| VinFast Auto India Pvt Ltd | 378 | 449 | +19% |

| BMW India Pvt Ltd | 317 | 408 | +29% |

| Kia India Private Limited | 561 | 378 | -33% |

| Hyundai Motor India Ltd | 459 | 306 | -33% |

| BYD India Private Limited | 539 | 259 | -52% |

| Mercedes-Benz | 117 | 87 | -26% |

| Tesla India Motors and Energy Pvt Ltd | 48 | 69 | +44% |

| Stellantis Automobiles India Pvt Ltd | 35 | 45 | +29% |

| Volvo Auto India Pvt Ltd | 42 | 41 | -2% |

| Porsche AG Germany | 6 | 6 | 0% |

| Rolls-Royce | 1 | 1 | – |

| Audi AG | 0 | 0 | – |

| Total | 18,374 | 17,438 | -5% |

Source: Vahan Dashboard, January 2026

#1 Tata.ev – Nexon EV, Tiago EV, Harrier EV

Tata.ev retained its clear leadership in December with 7,408 units, marking a marginal 2% decline from November.

Despite the month-on-month dip, Tata.ev continues to command the largest share of India’s passenger EV market. The Nexon EV and Tiago EV remain the brand’s volume drivers, while the Harrier EV’s early deliveries helped cushion the seasonal slowdown. Read more – Tata Motors Crosses 2.5 Lakh EV Sales, Leads India’s Electric Car Market.

Strong dealership reach, aggressive pricing, and mass-market appeal continue to keep Tata.ev well ahead of competitors.

#2 MG Motor India – Windsor EV, ZS EV, Comet EV

MG Motor India sold 4,302 units in December, a 7% decrease from November.

MG Motor India sold 4,302 units in December, a 7% decrease from November.

The ZS EV and Comet EV maintained stable demand, while the Windsor EV continued to contribute fleet and corporate volumes. Although MG saw a slightly sharper correction than Tata and Mahindra, it remains the second-largest EV OEM and Tata’s closest challenger in the segment.

#3 Mahindra Electric Automobile – XUV400, BE6, XEV 9e

Mahindra posted 3,679 units in December, registering a marginal 1% month-on-month decline.

The brand’s performance indicates a stable demand base, supported by the XUV400 and growing interest around Mahindra’s BE-series electric SUVs. Mahindra’s EV strategy remains focused on lifestyle-oriented SUVs, which continue to resonate with urban buyers.

Expanding its EV portfolio Recenlty, Mahindra also launched the Mahindra XEV 9s and XUV300 EV in India.

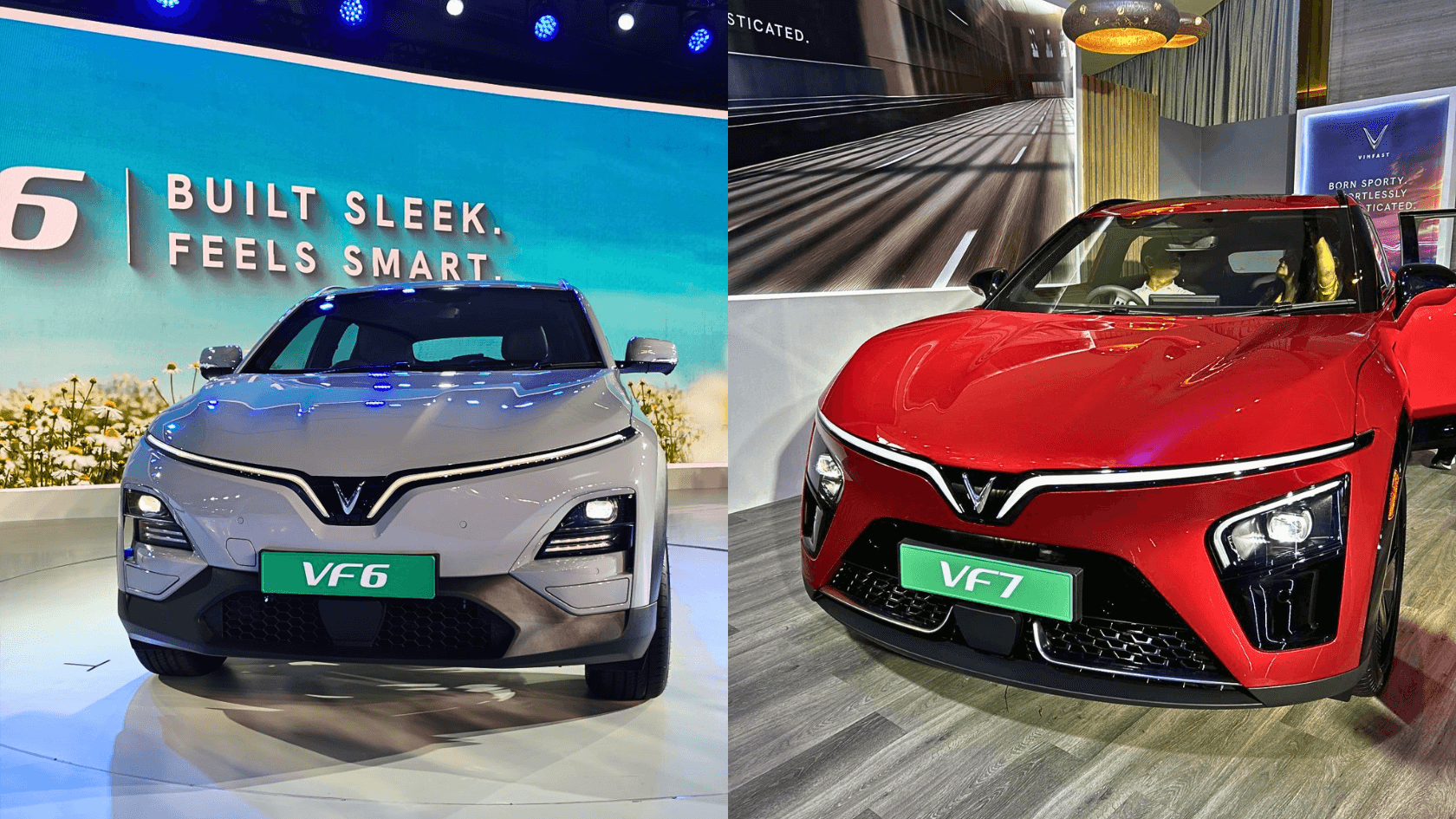

#4 VinFast Auto India – VF Models

VinFast emerged as a notable gainer in December, registering 449 units, up 19% over November.

VinFast emerged as a notable gainer in December, registering 449 units, up 19% over November.

The increase suggests improving dealer-level traction and growing awareness, positioning VinFast as an emerging player to watch in India’s evolving EV landscape.

#5 BMW India – i4, iX, i7

BMW India delivered 408 units in December, a strong 29% month-on-month growth.

BMW India delivered 408 units in December, a strong 29% month-on-month growth.

Luxury EV demand picked up towards year-end, driven by premium sedans and SUVs. BMW continues to lead the luxury EV segment in India, benefitting from consistent supply and strong brand recall.

#6 Kia India – EV6 & EV9

Kia registered 378 units in December, reflecting a 33% decline from November.

The drop appears linked to delivery batching and inventory cycles rather than demand erosion. The EV6 and EV9 continue to maintain Kia’s presence in the premium EV space, especially in metro markets.

#7 BYD India – Atto 3, e6 & Seal

BYD recorded 259 units in December, down 52% month-on-month.

BYD recorded 259 units in December, down 52% month-on-month.

The sharp decline highlights the brand’s supply-dependent sales model. While demand remains steady for the e6 fleet model and Seal sedan, monthly volumes fluctuate based on shipment schedules.

#8 Hyundai Motor India – Creta EV & Ioniq 5

Hyundai posted 306 units in December, a 33% decline from November.

Hyundai posted 306 units in December, a 33% decline from November.

The Creta EV continues to anchor volumes, while the Ioniq 5 serves a niche premium audience. Hyundai is expected to strengthen its EV portfolio in 2026, which could improve consistency.

Luxury & Premium EV Segment Snapshot – December 2025

The luxury EV segment showed mixed performance in December.

-

BMW and Tesla recorded strong growth

-

Mercedes-Benz and BYD saw corrections

-

Ultra-luxury brands like Porsche and Rolls-Royce remained niche but stable

Tesla’s volumes remain limited and allocation-driven, though December saw a noticeable uptick.

Final Thoughts

December 2025 extended the year-end normalization trend in India’s electric passenger vehicle market, with total E4W sales declining 5% month-on-month.

Key takeaways:

-

Tata.ev, MG Motor India, and Mahindra continue to dominate the segment

-

Select premium brands outperformed despite overall softness

-

Supply cycles significantly influenced MoM volatility

-

Core consumer demand for EVs remains structurally strong

With multiple launches expected in early 2026 and evolving state-level EV incentives, India’s electric car market remains well-positioned for sustained long-term growth.

Add a comment Cancel reply

Categories

- Auto Detailing (2)

- EV Market Analysis (3)

- EV News (3,505)

- EV Reviews (1)

- Uncategorized (560)

Recent Posts

About us

Popular Tags

Related posts

Electric Car Sales December 2025: Brand-wise EV Market Share

Electric Car Sales December 2025: Brand-wise EV Market Share

Electric Car Sales December 2025: Brand-wise EV Market Share

- 404 Page

- About us

- Auto Sales

- Auto Sales Dashboard

- Blog

- Business Opportunities

- Compare

- Contact

- FAQ

- Home

- Homepage Car Dealer

- Homepage Classic

- Homepage Location

- Homepage Modern

- Homepage Mosaic

- Homepage Slideshow

- How to Save with EV – Series 1 – Driver Se Owner Bano

- Landing Page

- Loan Calculator

- Loan Calculator test

- Login / Register

- Map Search

- Our team – simple

- Panel

- Sales Insights

- Sales Dashboard

- Sold

- Subscribe to Vahan Sales Charts

- Tableau Dashboard

- Vehicle Sales

- Vehicle Sales Across India

- 404 Page

- About us

- Auto Sales

- Auto Sales Dashboard

- Blog

- Business Opportunities

- Compare

- Contact

- FAQ

- Home

- Homepage Car Dealer

- Homepage Classic

- Homepage Location

- Homepage Modern

- Homepage Mosaic

- Homepage Slideshow

- How to Save with EV – Series 1 – Driver Se Owner Bano

- Landing Page

- Loan Calculator

- Loan Calculator test

- Login / Register

- Map Search

- Our team – simple

- Panel

- Sales Insights

- Sales Dashboard

- Sold

- Subscribe to Vahan Sales Charts

- Tableau Dashboard

- Vehicle Sales

- Vehicle Sales Across India

- 404 Page

- About us

- Auto Sales

- Auto Sales Dashboard

- Blog

- Business Opportunities

- Compare

- Contact

- FAQ

- Home

- Homepage Car Dealer

- Homepage Classic

- Homepage Location

- Homepage Modern

- Homepage Mosaic

- Homepage Slideshow

- How to Save with EV – Series 1 – Driver Se Owner Bano

- Landing Page

- Loan Calculator

- Loan Calculator test

- Login / Register

- Map Search

- Our team – simple

- Panel

- Sales Insights

- Sales Dashboard

- Sold

- Subscribe to Vahan Sales Charts

- Tableau Dashboard

- Vehicle Sales

- Vehicle Sales Across India